Center for Leadership Development prepares youth for success in school and in life. Your generous, tax-deductible contribution will help CLD further its mission of fostering the advancement of minority youth in Central Indiana as future professional, business, and community leaders by providing experiences that encourage personal development and educational attainment.

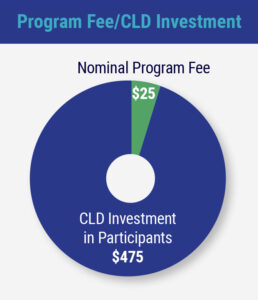

CLD is a not-for-profit organization that puts values into practice through programs that cultivate character, empower youth and enrich community. When you give to CLD, you are doing your part to build tomorrows leaders, today. In fact, CLD is so passionate about the youth it serves that for every program participant registered, CLD makes a $475 investment. With the average program fee of just $25 for an exceptional program experience ranging from 4 to 13 weeks, we remain proud of our charitable status and rely on funders like you to keep our mission alive and thriving.

CLD is a not-for-profit organization that puts values into practice through programs that cultivate character, empower youth and enrich community. When you give to CLD, you are doing your part to build tomorrows leaders, today. In fact, CLD is so passionate about the youth it serves that for every program participant registered, CLD makes a $475 investment. With the average program fee of just $25 for an exceptional program experience ranging from 4 to 13 weeks, we remain proud of our charitable status and rely on funders like you to keep our mission alive and thriving.

Our goal is to align your philanthropic interests with the growing needs of our organization. We are pleased to offer a wide variety of giving options, developed with you in mind.

CLD is a 501(c )(3) non-profit charity and all donations are tax-deductible as allowed by IRS regulations.

Donor Privacy

We guarantee that personal donor information will be kept confidential. View the donor bill of rights below. DONOR BILL OF RIGHTS

A one-time or recurring gift can be made with cash, check or credit card

Center for Leadership Development

Development Department

2425 Dr. Martin Luther King Jr. Street

Indianapolis, IN 46208

Kroger Community Rewards Program: Shop at Kroger and swipe your Shopper’s Card—no fees, no extra cost.

Your employer and coworkers can join you in helping our youth. There are multiple ways to get involved through workplace giving, including payroll deductions and matching gifts.

Be a part of our future by including Center for Leadership Development in your estate plans. Your legacy can help support our shared vision of building a culture of academic and career excellence.

An increasingly popular charitable vehicle, donor advised funds are an excellent way to both simplify your charitable giving and facilitate your strategic philanthropic goals. Connect with your financial advisor to learn more about this opportunity.

Stocks, bonds, or any other securities can be transferred as gifts. If the stock has appreciated in value, the holder can avoid paying the capital gains tax by giving it as a gift.

For more information on this opportunity, please contact the Development Department at 317-923-8111, email Joi Edwards at [email protected] connect with your financial advisor or review our Gift of Appreciated Stock resources below:

Appreciated mutual fund shares held for more than a year provide the same income tax deduction for the value of the gift as stocks held individually, without being taxed on the capital gain.

For more information on this opportunity, please contact the Development Department at 317-923-8111, email Joi Edwards at [email protected], connect with your financial advisor or review our Gift of Appreciated Stock resources below:

The Center for Leadership Development has earned GuideStar’s PLATINUM Seal of Transparency. This industry honor is awarded to charitable organizations that are found to be transparent and trustworthy. CLD is determined to be open, honest an transparent with all of its’ donations, and excellent steward of every resource. We commit to upholding the highest industry standards to ensure that donors can confidently support our work.

Your gift means the world to our students. Annual contributions from our generous donors allows us to provide free college readiness services, new or improved programs and initiatives, improvements to our building, excellent staff, and meaningful support to enhance the student experience.